Understanding Pakistan’s Real Estate Market Dynamics

The real estate market in Pakistan is highly diverse and includes residential, commercial, and agricultural land. The market is influenced by several key factors, including:

Economic conditions: Pakistan’s economic growth, inflation rates, and overall stability play a big role in property value fluctuations.

Demand and supply: The demand for housing continues to rise due to population growth, urbanization, and increasing middle-class aspirations.

Government policies: Changes in government regulations, incentives for investors, and tax laws can impact real estate market trends.

Before investing, it is crucial to stay updated on the current market trends and understand the cyclical nature of property value appreciation. Regions like Lahore, Karachi, Islamabad, and Gwadar are hotspots for investment, each offering different prospects.

_________________________________________________________________________

Key Locations for Property Investment

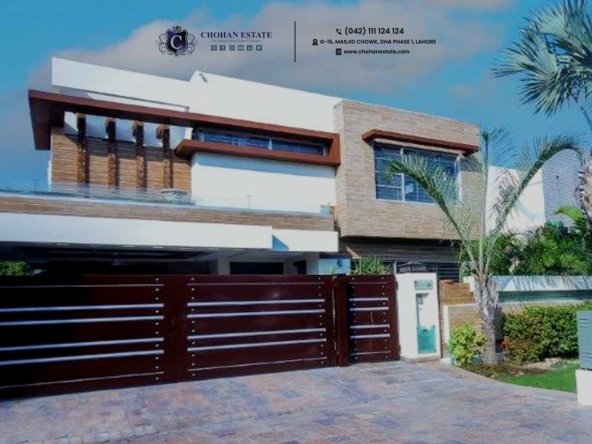

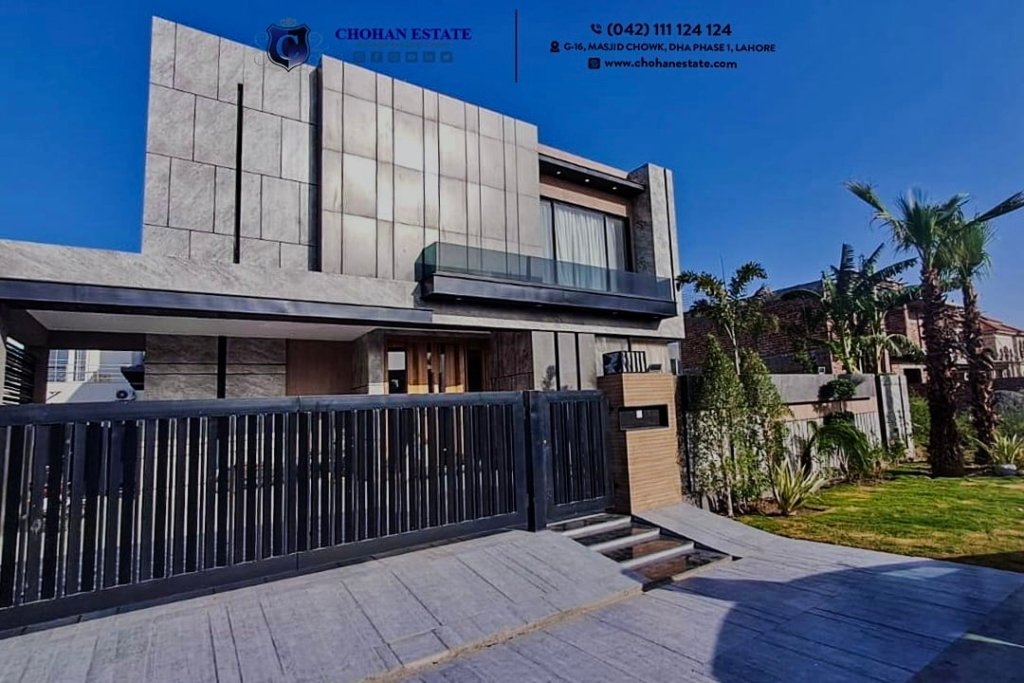

Lahore

Lahore, the cultural hub of Pakistan, has seen a surge in both residential and commercial projects. DHA (Defence Housing Authority), Bahria Town, and Gulberg are among the most sought-after areas for investors. The city’s infrastructure development and rising demand for quality housing make it a promising investment option.

Karachi

As the financial capital of Pakistan, Karachi offers some of the most valuable real estate in the country. Areas like Clifton, DHA, and Bahria Town Karachi are preferred choices for high-end investors, while Gulshan-e-Iqbal and Korangi cater to mid-tier investments. Karachi’s thriving business activities make it a prime location for commercial real estate investments.

Islamabad

The capital city, with its serene environment, well-planned infrastructure, and increasing demand for residential housing, is attracting investors, especially in areas like F-6, G-11, DHA Islamabad, and Bahria Town. Islamabad’s growing tech sector and foreign investments are pushing property prices upward.

Gwadar

Gwadar is positioned as the next big thing in Pakistan’s real estate market due to the China-Pakistan Economic Corridor (CPEC). Investments here are speculative but have the potential for massive returns in the long run as development progresses.

Other Emerging Cities

Cities like Multan, Faisalabad, and Peshawar are witnessing rapid development due to infrastructure improvements and industrial growth, making them potential hotspots for investors.

_________________________________________________________________________

Legal Aspects of Real Estate Investment

Investing in property in Pakistan requires careful attention to legal procedures and due diligence to avoid potential pitfalls. Here are some legal considerations:

Title Verification: Always verify the property title before investing. Ensure that the seller has the legal right to sell the property and that the property isn’t involved in any disputes.

Registration and Documentation: The sale deed must be registered at the sub-registrar’s office. Proper documentation includes transfer letters, sale agreements, no objection certificates (NOCs) from relevant authorities, and tax records.

Zoning and Land Use: Before purchasing land, understand the zoning laws and land-use permissions. This is especially important if you are investing in commercial or agricultural property.

Role of a Real Estate Lawyer: Hiring a lawyer who specializes in property law can help navigate the complexities of real estate transactions. They can help with title searches, agreement drafting, and any potential legal disputes.

_________________________________________________________________________

Financing Options for Property Investment

Understanding financing options is crucial, especially for investors who plan to use leverage. There are several options for financing a property investment in Pakistan:

Bank Loans and Mortgages: Many banks in Pakistan, including Habib Bank, UBL, and Meezan Bank, offer home loans and property financing options. You must meet certain eligibility criteria, and interest rates can vary depending on market conditions and the financial institution’s policies.

Islamic Financing: Islamic banks offer Sharia-compliant financing options, such as diminishing Musharakah, which is a popular choice among Muslim investors.

Personal Savings: Some investors prefer to use personal savings or funds from family sources to avoid interest and bank involvement.

Developer Payment Plans: Several housing schemes and developers offer flexible payment plans where you can pay in installments over time. This is a viable option for those who don’t want to take out a loan but need some time to make full payments.

_________________________________________________________________________

Tax Implications

Property investment in Pakistan comes with certain tax obligations, and understanding these can help you avoid potential legal issues:

Capital Gains Tax (CGT): If you sell property within a specified period after purchase, you may be subject to CGT. The rate and period vary depending on government policies.

Withholding Tax (WHT): Both buyers and sellers must pay withholding tax at the time of property transfer. The rate differs depending on the type of property and the tax-filer status of the parties involved.

Property Tax: This is an annual tax levied by the government based on the value of the property. Residential and commercial properties are taxed at different rates.

Income Tax on Rental Income: If you are investing in a rental property, you are required to pay income tax on the rental income, which can affect your overall returns.

Consulting a tax advisor or property consultant will help you understand the exact tax obligations based on your investment and how to minimize liabilities.

_________________________________________________________________________

Risks and Mitigation Strategies

While property investment in Pakistan can be highly rewarding, it comes with risks. Here are a few risks and how you can mitigate them:

Market Volatility: Real estate prices can fluctuate due to political instability, economic downturns, or global market conditions. To mitigate this risk, diversify your portfolio by investing in different types of properties (residential, commercial, or agricultural) and in various locations.

Fraudulent Schemes: Unfortunately, the real estate market in Pakistan is sometimes plagued with fraudulent schemes or illegal developments. Always verify the credibility of developers and agents, and ensure all legal documents are authentic.

Lack of Liquidity: Real estate is not as liquid as other investments like stocks. If you need cash quickly, it may be hard to sell your property at the desired price. To mitigate this, invest in regions with high demand, ensuring quicker sales if needed.

Project Delays: If you are investing in under-construction properties, project delays can be a common issue. To avoid this, invest with reputable developers who have a proven track record of timely project completion.

_________________________________________________________________________

Long-Term Vs. Short-Term Investment Strategies

Long-Term Investments: If you are in it for the long haul, consider investing in upcoming or underdeveloped areas such as Gwadar or areas near major highways and transport hubs. These investments tend to appreciate significantly over time but may take a few years to yield returns.

Short-Term Investments: For short-term gains, target well-established areas like DHA and Bahria Town in major cities, where property demand is high, and prices fluctuate more rapidly. However, short-term investments carry a higher risk of market volatility.

_________________________________________________________________________

Summary

Investing in property in Pakistan can be an excellent way to build wealth, provided you carefully consider market conditions, location, legal aspects, and risks. Whether you are looking for long-term appreciation or short-term gains, having a well-thought-out strategy will help you maximize your returns. Be sure to stay informed about market trends, work with reliable developers and agents, and understand the tax implications of your investment.

With the right approach, property investment in Pakistan can be a rewarding endeavor, offering both financial security and the opportunity to be part of the country’s rapidly evolving real estate landscape.