The real estate sector in Pakistan plays a critical role in the nation’s economy, contributing significantly to GDP and employment generation. Over the years, this industry has seen tremendous growth, driven by a burgeoning middle class, increased urbanization, and substantial foreign investment, particularly from expatriate Pakistanis. However, despite its promising outlook, the market is often influenced by various challenges such as regulatory hurdles, political instability, and inconsistent government policies. This comprehensive overview will delve into the key dynamics of Pakistan’s real estate market, its drivers, the challenges it faces, and its future outlook.

_________________________________________________________________________

Growth of Real Estate in Pakistan: A Historical Perspective

Real estate in Pakistan has grown rapidly, particularly in the last two decades. Historically, property investment has been considered a safe and profitable venture, making it one of the preferred investment options for both locals and expatriates. This growth accelerated with the establishment of private housing schemes like Bahria Town, DHA (Defence Housing Authority), and others that cater to upper and middle-class segments. These developments have led to a boom in urban housing, particularly in major cities such as Karachi, Lahore, Islamabad, and Rawalpindi.

Moreover, the introduction of CPEC (China-Pakistan Economic Corridor) projects has significantly impacted the real estate sector, with increased demand for commercial and residential properties in areas surrounding key infrastructure projects, like Gwadar. CPEC has sparked interest in new housing developments, business centers, and logistics hubs.

_________________________________________________________________________

Key Drivers of the Real Estate Market

Several factors contribute to the steady growth of Pakistan’s real estate sector, ranging from demographic trends to foreign investments and infrastructure developments.

Urbanization and Population Growth

Pakistan’s rapidly growing population and urbanization are central to the growth of the real estate market. As rural populations move to urban centers for better opportunities, cities like Lahore, Karachi, and Islamabad are experiencing significant expansion. According to the World Bank, Pakistan’s urban population is expected to double by 2050, which will continue to fuel demand for housing, commercial spaces, and infrastructure development.

Increasing Middle-Class

The rise of the middle class has also led to a surge in demand for residential properties. More Pakistanis now seek better living standards, translating into demand for modern housing societies, apartment complexes, and gated communities offering amenities like security, parks, and shopping areas.

Overseas Pakistani Investment

Overseas Pakistanis are major contributors to the real estate sector, sending billions of dollars in remittances each year, a large portion of which is invested in property. In many cases, expatriates purchase real estate as a secure investment or as part of plans for eventual relocation back to Pakistan. The government has introduced schemes and incentives to encourage more overseas Pakistanis to invest in the real estate sector, such as Roshan Digital Accounts, which offer hassle-free remittances for property investments.

Government Incentives

The government of Pakistan has periodically introduced various incentives to spur growth in the real estate sector. For instance, the construction package introduced in 2020 under the Naya Pakistan Housing Program (NPHP) aimed at providing affordable housing for the lower-income segment has also had a ripple effect on the broader real estate market. Tax relief measures for the construction industry, relaxation in approval processes, and initiatives like the Real Estate Investment Trust (REIT) structure are all part of efforts to streamline and boost the sector.

_________________________________________________________________________

Segments of the Real Estate Market

The real estate market in Pakistan can broadly be divided into several key segments: residential, commercial, industrial, and agricultural properties.

Residential Real Estate

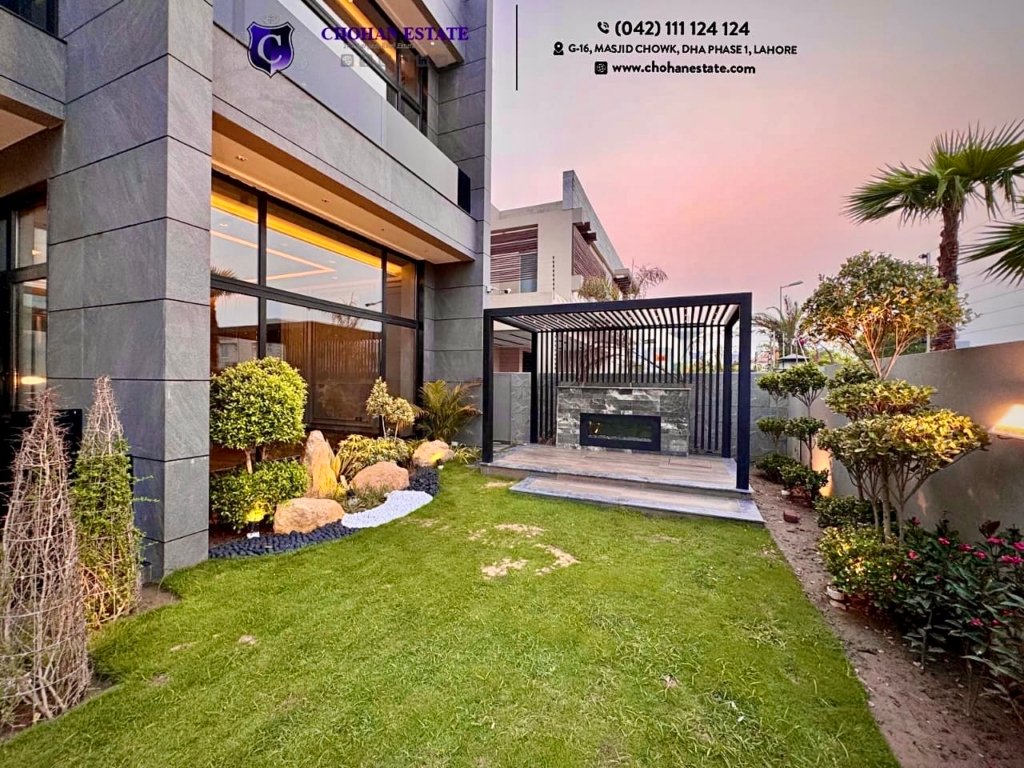

The residential real estate sector remains the most active and profitable segment. Major cities like Lahore, Karachi, and Islamabad are home to luxury housing schemes such as DHA and Bahria Town. Middle-income housing schemes are also gaining popularity as developers focus on affordability while offering modern amenities. Affordable housing is still an underserved market, though government initiatives like the NPHP aim to address this gap.

Commercial Real Estate

The commercial real estate sector has also seen a surge in demand, especially in urban centers. Malls, office buildings, and commercial plazas are being developed at a rapid pace. Cities like Lahore and Karachi have witnessed the rise of mixed-use developments, combining retail, office, and residential spaces under one roof. With the increase in entrepreneurship and business activities, demand for office spaces and commercial units continues to rise.

Industrial and Agricultural Real Estate

Though not as dynamic as the residential and commercial sectors, industrial real estate in Pakistan is witnessing growth due to CPEC-related projects and the demand for manufacturing and logistics hubs. Similarly, agricultural land continues to be an important asset, especially in Punjab and Sindh, where farming remains the backbone of the economy.

_________________________________________________________________________

Challenges Facing Pakistan’s Real Estate Market

Despite its growth potential, the real estate market in Pakistan faces significant challenges that hinder its full potential. Understanding these challenges is crucial for investors, developers, and policymakers.

Regulatory Hurdles and Legal Issues

One of the most significant barriers to growth is the lack of proper regulation and oversight in the real estate market. Property ownership disputes, fraudulent practices by developers, and unclear titles are common issues that potential buyers face. The lack of a centralized property database further complicates transactions, leading to delays and legal battles.

Political and Economic Instability

The real estate market in Pakistan is highly sensitive to political and economic instability. Fluctuations in economic conditions, currency depreciation, and changes in government policies can cause uncertainty for investors and developers. For example, high inflation rates and rising construction costs have led to increased property prices, making real estate investments less accessible to the middle class.

Lack of Affordable Housing

Despite several initiatives, affordable housing remains a challenge in Pakistan. The demand for affordable housing far exceeds the supply, particularly for the lower-middle-class segment. High land prices, construction costs, and limited financing options make it difficult for developers to offer affordable housing options at scale.

Infrastructure Deficits

Although Pakistan has seen improvements in its infrastructure, many areas still lack basic facilities like proper roads, water supply, and sewage systems. This not only affects the quality of life in new developments but also hampers the growth of the real estate market in rural and semi-urban areas.

_________________________________________________________________________

The Role of Technology in Real Estate

The real estate sector in Pakistan is gradually adopting technology to improve processes and enhance transparency. Property technology (prop-tech) platforms, such as zameen.com and chohanestate.com, have revolutionized how properties are bought and sold. These platforms offer users access to property listings, market trends, and transaction data, increasing transparency and making it easier for buyers and sellers to navigate the market.

Virtual tours, online booking systems, and AI-powered customer service tools are becoming more prevalent, particularly post-COVID-19. These tools enable developers and realtors to reach a wider audience, including overseas buyers, while minimizing the need for physical site visits.

_________________________________________________________________________

Future Outlook of the Real Estate Market

Despite the challenges, the future of Pakistan’s real estate market remains promising. Urbanization, population growth, and infrastructure development will continue to drive demand for residential and commercial properties. The introduction of modern infrastructure projects such as new motorways, airports, and industrial zones as part of the CPEC initiative will further boost the demand for real estate in strategic locations.

Moreover, government initiatives to digitize land records and streamline property transactions could help mitigate many of the regulatory and legal issues that currently plague the market. The introduction of Real Estate Investment Trusts (REITs) in Pakistan could also make the market more accessible to smaller investors and improve liquidity.

With increasing emphasis on eco-friendly construction and the adoption of smart city concepts, future developments are likely to focus on sustainability, energy efficiency, and community-centric designs.

_________________________________________________________________________

Summary

The real estate market in Pakistan presents both tremendous opportunities and significant challenges. It continues to grow, fueled by urbanization, an expanding middle class, and foreign investment. However, overcoming regulatory barriers, addressing the need for affordable housing, and improving infrastructure will be crucial for sustained growth. By leveraging technology, enhancing transparency, and fostering more efficient government policies, Pakistan’s real estate sector can unlock its full potential, becoming a key driver of economic growth in the coming years.

Join The Discussion